Calculate gas mileage reimbursement

If a company provides a reimbursement higher than the IRS standard mileage rate that reimbursement becomes. How to Calculate Mileage Reimbursement.

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

If youre self-employed as a sole proprietor independent contractor or partner you have a choice between calculating the deduction using the standard mileage rate or with actual car expenses which requires keeping receipts for gas and other car-related payments.

. Employees maintain a mileage log and are reimbursed either weekly bi-weekly or monthly depending on their employer. As gas prices continue to rise the Internal Revenue Service is increasing the optional standard mileage rate used to calculate tax deductions by 4 cents a mile for the last six months of 2022. The Internal Revenue Service announced gas mileage reimbursement rates for 2020 in December.

This calculator uses the following formula to calculate the CPS. You can claim 16 cents per mile driven in 2021 but theres a catch. You can deduct your mileage at the standard rate of 18 cents per mile for 2022 and 16 cents per mile for 2021 or you can deduct your actual costs of gas and oil.

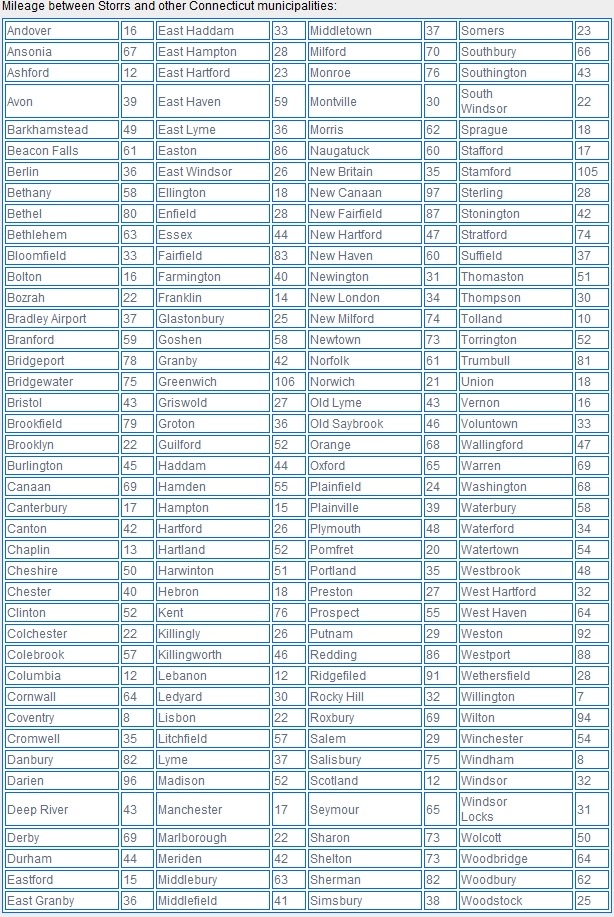

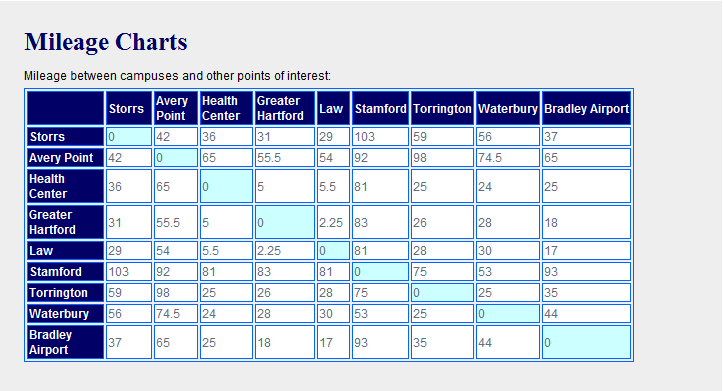

So if you live in Kansas drive from Great Bend to Ellinwood. Who Can Deduct Mileage for Medical Reasons. Travelers shall calculate the total mileage claimed out to the third decimal point and round down to the nearest cent when mileage is to be reimbursed.

We earlier published 2010 mileage reimbursement calculator that can be used to compute the gas reimbursement for 2019 as well. Trip log app SureMobile is the most accurate employer system for mileage reimbursement and expense management. Employees must return any excess amounts in a reasonable amount of time.

The 2018 Elantras five-year costs for gas insurance repairs and maintenance are projected to be about 21420 or 4284 per year. You can calculate your. Dakota is a sales manager for a pharmaceutical company.

Mileage accrued when driving to and from doctor visits the pharmacy and the hospital can all count toward a medical deduction. Repairs tires maintenance gas and oil. Where can I find the official IRS mileage rates.

GSA has adjusted all POV mileage reimbursement rates effective July 1 2022. Toggle navigation Call 888 255-8855 See a Demo Now login. It comes after a 25-cent increase went into effect in January and.

Notice 2021-02 PDF should be referredIt contains the optional 2021 standard mileage rates as well as the maximum automobile cost used to calculate the allowance under a fixed. If you frequently drive your car for work you can deduct vehicle expenses on your tax return in one of two ways. If you dont keep detailed records your expense report may.

If anyone wants to calculate the mileage of his car or bike he should go for a long ride like riding or driving from California to Newyork city hmmm its too far. Vicinity Mileage Claimed When privately owned vehicles are used for business related travel vicinity Mileage allowance at a fixed rate of 0445 per mile shall be reimbursed. IRS gas mileage reimbursement rate.

Many vehicles were returning to dealerships in excellent condition so rather than sending them to auction manufacturers created programs to resell the cars complete with detailed inspections reconditioning extended warranties extra perks and. Its worked with the IRS since 1980 to calculate the business mileage deduction rate using a consistent method and statistical analysis of vehicle cost components. The special adjustment starts July 1 and brings the IRS rate to 625 cents per mile.

Modes of Transportation EffectiveApplicability Date Rate per mile. Gas prices which receive a lot of weight during cost analysis depend on global controls and fluctuate daily. The first step to calculate mileage expenses is to determine what qualifies for mileage reimbursement.

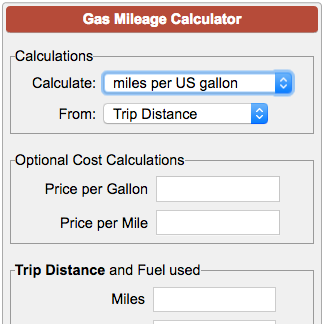

For this year the mileage rate in 2 categories have gone down from previous years. The IRS monitors trends in business driving based on analysis from the worlds largest retained pool of drivers to calculate this rate which is then used to determine taxation. Select the cell in which you want to display your reimbursement amount and click inside the Formula Bar.

There are two allowable methods for calculating the annual deduction. Some companies will even offer various ways to pay for employee mileage. The IRS mileage reimbursement rate is a number recommended by the Internal Revenue Service.

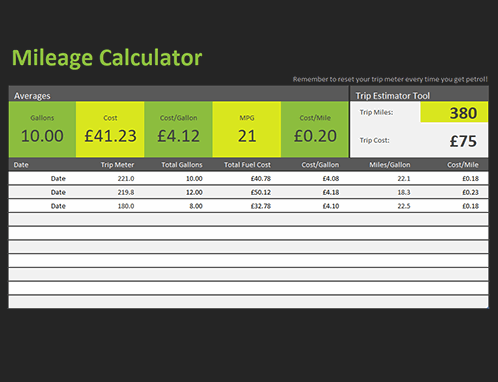

Number of Clicks Number of Seconds CPS Clicks Per Second You may also be interested in our eDPI Calculator or PPI Pixels Per Inch Calculator. IR-2022-124 June 9 2022 The Internal Revenue Service today announced an increase in the optional standard mileage rate for the final 6 months of 2022. If you plan to calculate mileage reimbursement you should have detailed mileage logs.

Across the country costs for expenditures such as gas insurance and maintenance can vary dramatically. To delve a little deeper well first need to go through the rules of mileage reimbursement. The first and most comprehensive method is to document all of your car expenses including gas maintenance insurance and depreciation.

What factors will determine the 2022 IRS mileage rate. Enter the mileage rate in an unused cell on the worksheet. You can take a medical tax expense deduction only if your overall unreimbursed medical costs exceed 75 of your adjusted gross income AGI.

Mileage is the most common form of vehicle reimbursement. Enter the formula cell containing mileage_cell containing rate to calculate the total. Calculate mileage reimbursements if the template does not do so.

Prices range from 12500 to 19200 and vary depending on the vehicles condition mileage features and location. Airplane July 1 2022. The rate for medical and moving.

For mileage reimbursements this is often an official mileage log. In the early 1990s some automakers started CPO programs to bank on low-mileage trade-ins and lease returns. The mileage of a vehicle is calculated when someone fills his car or bike with Mapquest Driving Directions minimum 1-liter petrol or diesel.

Employers may choose to reimburse at higher or lower rates and many calculate a rate based on their location. However unlike the federal mileage rate the costs of owning a vehicle are not the same everywhere in the US. Employers who use the IRS mileage rate to reimburse employees for business mileage should be ready to apply the higher rate beginning July 1 2022 and ensure that their expense reimbursement policies are updated to reflect the increased mileage rate.

There is no standard reimbursement rate as companies can set their own rate. Many businesses establish a mileage rate that is less than the IRS mileage rate. That means oil gas and general maintenance as a result of wear and tear are covered as are parking fees and tolls depending on what your employer decides to include.

If use of privately owned automobile is authorized or if no Government-furnished automobile is available. Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes. The cost of driving and gas may be lower in one state.

Saad Vice President Labor and Employment Content Training and Advice CalChamber. See the Best Used Car Deals How Much Does the 2018 Hyundai Elantra Cost to Own. What Qualifies for Mileage Reimbursement.

Irs Mileage Rate For 2022

2021 Mileage Reimbursement Calculator

Company Mileage How Are Mileage Rates Determined

Irs Boosts Standard Mileage Rates For The Rest Of 2022 South Carolina Umc

Mileage Calculation Accounts Payable

Mileage Reimbursement Calculator

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand

Gas Mileage Calculator

Mileage Calculator

Deductible Mileage Rate For Business Driving Increases For 2022 Sol Schwartz

Mileage Calculation Accounts Payable

Mileage Calculator Credit Karma

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms

Use Our Rate Calculator To Budget For Mileage Reimbursement Costs

How To Calculate Mileage Reimbursement Guide To Deductions

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

Mileage Log Template Free Excel Pdf Versions Irs Compliant